santa clara property tax due date 2021

The ordinance is aimed at assisting taxpayers in which. Deadline to file all exemption claims.

Santa Clara County homesowners property taxes are due by 5pm Monday April 12 2021 to avoid late fees and penalties.

. Review property tax bills any place with an internet connection. The fiscal year for Santa Clara County Taxes starts July 1st. Fiscal Year 2020-21 Highlights.

August 31 - Unsecured tax payment deadline. The due date to file via mail e-filing or SDR remains the same. August 1- Unsecured tax payments due.

2021-2022 for July 01 2021 through June 30 2022 ASSESSORS PARCEL NUMBER APN. Installment 2 is due February 1 and is delinquent April 10th. 2021-2022 for july 01 2021 through june 30 2022 assessors parcel number apn.

Find Records For Any City In Any State By Visiting Our Official Website Today. Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment. Due date delinquent after taxes and special assessments 10 delinquent penalty delinquent cost.

JANUARY 1 - This is the date when taxes for the next fiscal year become a lien on the property. January 22 2022 at 1200 PM. Second Installment of the 2021-2022 Annual Secured Property Taxes is Due February 1 and Becomes Delinquent after April 11.

SANTA CLARA COUNTY CALIF. As the official tax due date falls on Saturday April 10 when the physical office is closed the deadline for all payments is extended to 5. Secured taxes are due in two installments.

Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. December 10 2021 DUE BY. FEBRUARY 1 - Second installment due on.

Although you might expect the two bills to be due payable 6 months apart thats not how it works. Payments are due as follows. Look up prior years bills and payments.

Secured property tax bill tax year. On Monday April 12 2021. The Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2020-2021 property taxes becomes delinquent if not paid by 5 pm.

Home - Department of Tax and Collections - County of Santa Clara. SANTA CLARA COUNTY CALIF. Second installment of taxes due covers Jan 1 June 30.

Installment 1 is due November 1 and is delinquent December 10th. 2021-2022 county of santa clara secured property taxes - 1st installment sec-reg-202108 1. SANTA CLARA COUNTY CALIF.

The ordinance exempts from taxation all business property where the aggregate assessed value is less than 10000. Unsecured taxes are due on lien date January 1 of each year and become delinquent after August 31. January 31 2022 DELINQUENT TAX DUE DELINQUENT TAX DUE Special Assessments.

FY 2020-21 July 1 2020 through June 30 2021 is the tenth consecutive year in which. The second installment is due and payable on February 1. Agencies in the County of Santa Clara.

Due date delinquent after taxes and special assessments 10 delinquent penalty delinquent cost returned payment fee less amount paid total installment amount 12102021. 2021-22 For July 01. The First Installment of the 2020-2021 Annual Secured Property Taxes is due on Monday November 2 2020.

Taxes due for July through December are due November 1st. Ad One Simple Search Gets You a Comprehensive Santa Clara Property Report. 2021-2022 county of santa clara secured property taxes - 1st installment sec-reg-202108 1 2 10394 n stelling rd cupertino ca 95014 10394 n stelling rd.

067 of home value. Pay your Property Tax bill online. See the assessed value of your property.

Second installment of secured taxes due. DECEMBER 10 - Last day to pay First Installment of Secured Property Taxes late payments incur a 10 penalty if not postmarked by December 10 received in our office as of 500 pm or by midnight online. The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due.

The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due February 1 and becomes delinquent at 5 pm. Santa Clara County has one of the highest median property taxes in the United. The first installment is due and payable on November 1 and becomes delinquent if not paid by December 10.

Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April. First installment of taxes due covers July 1 December 31st. Business Property Statements are due April 1.

September 1 - Unpaid unsecured taxes are transferred to the Collections Division and a 10000 fee is added. The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax bills to all property owners at the address shown on the tax roll. November 01 2021 DELINQUENT TAX DUE County of Santa Clara Department of Tax and Collections 70 West Hedding Street East Wing 6th Floor San Jose California 95110-1767 SECURED PROPERTY TAX BILL TAX YEAR.

Due Dates of Property Taxes. Other fees are added by the Collections Division with continued delinquency. Yearly median tax in Santa Clara County.

Manage your contact informationyou can tie your account to more than one. April 1 2021 at 1200 PM. Property Tax Email Notification lets you.

Due date for filing statements for business personal property aircraft and boats. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time. October 19 2020 at 1200 PM.

Low Value Ordinance The Assessor introduced the low valueminimum assessment ordinance adopted by the Board of Supervisors which provides property tax relief to thousands of small businesses. Second Installment of the 2020-2021 Annual Secured Property Taxes Due by April 12 and Becomes Delinquent after 5 pm. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Get email reminders that your taxes are due. A 10 penalty is added as of 500 pm.

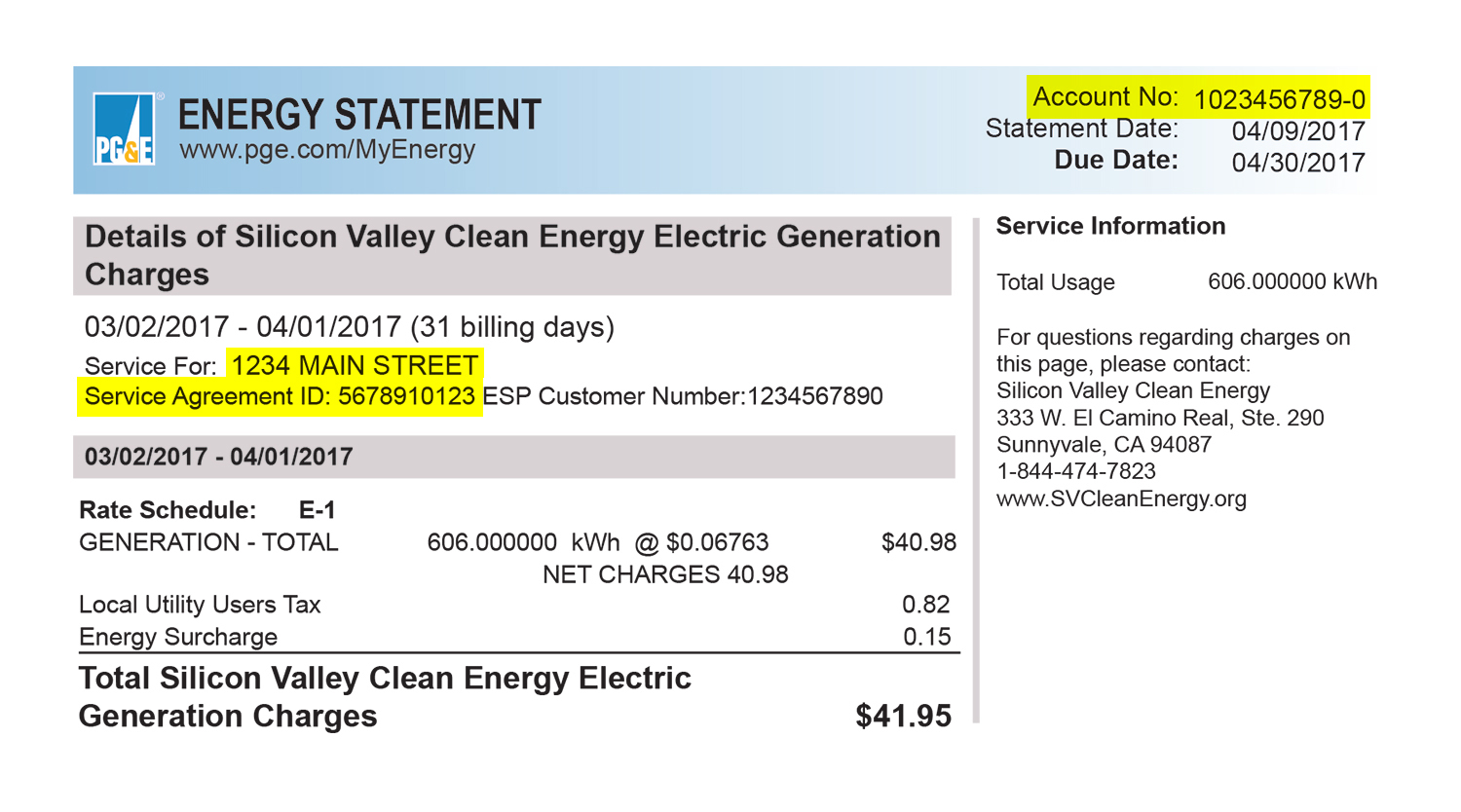

How Can I Be Eligible For Silicon Valley Clean Energy Svce Funds Calevip

Property Taxes Department Of Tax And Collections County Of Santa Clara

Anatomy Of A Criminal Case Office Of The District Attorney County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

Santa Clara County Assessor Tells All Employees To Telework Says It S Not Related To Employee Testing Positive For Covid 19 The Silicon Valley Voice

California Mortgage Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

211 Bay Area 211bayarea Twitter

Property Taxes Department Of Tax And Collections County Of Santa Clara

Will You Get A Check Final Round Of California Stimulus Payments Due By Jan 11

A Look At What S Ahead In The California Governor Recall Effort

Tax Return Problem S21 1 Doc Tax Return Problem Acct 374 Spring 2021 Dr Swenson Please Prepare A 2020 Federal Individual Income Tax Return For The Course Hero